Property Tax Rate West Newbury Ma . Assessments reflect the market value as of january 1, 2022. the values are based upon calendar year 2021 sales data. do not use the fy24 tax rate to calculate your property taxes. Based on the town’s budget and the final revised. as well as, deliver excellent service to the community in the most fiscally responsible manner. the due date of your real and personal property tax bill has been extended to june 1, 2020. the fy2023 tax rate is $11.03 per thousand. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. June 1, 2020 is the new. we encourage owners to take the time to review the information specific to their properties. Should you discover any errors,.

from taxfoundation.org

the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. Based on the town’s budget and the final revised. Assessments reflect the market value as of january 1, 2022. Should you discover any errors,. do not use the fy24 tax rate to calculate your property taxes. as well as, deliver excellent service to the community in the most fiscally responsible manner. the fy2023 tax rate is $11.03 per thousand. June 1, 2020 is the new. the values are based upon calendar year 2021 sales data. the due date of your real and personal property tax bill has been extended to june 1, 2020.

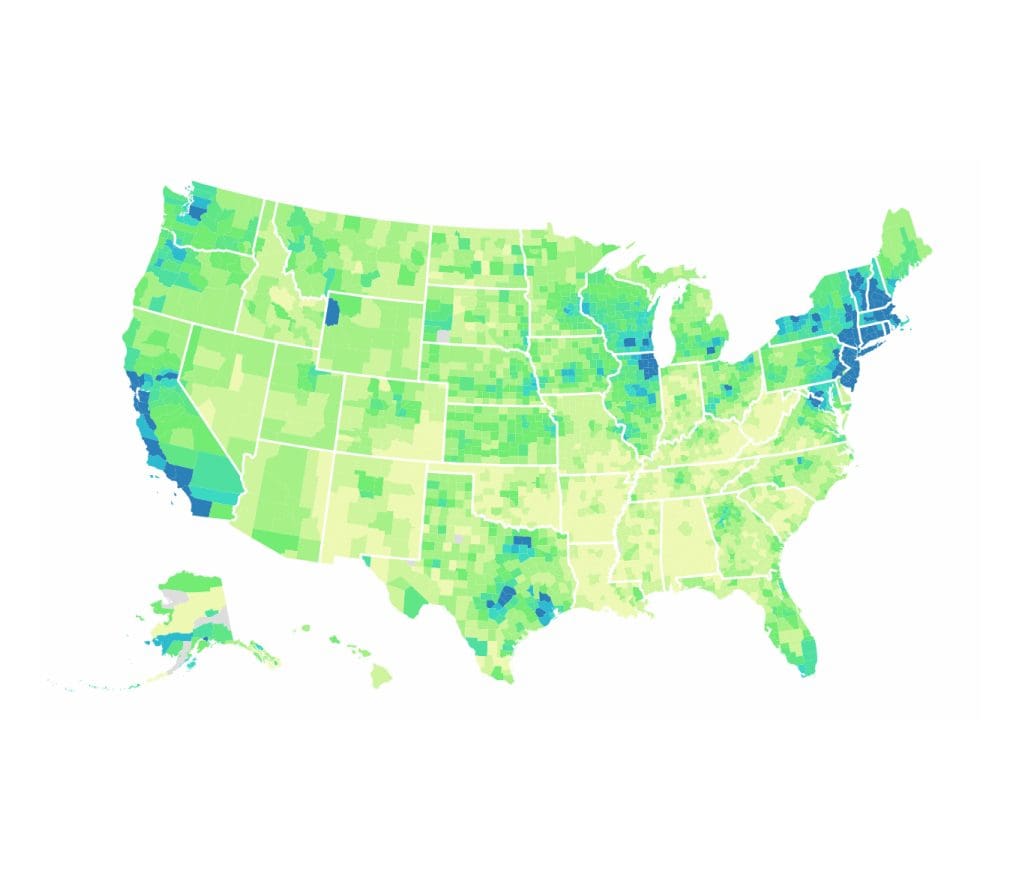

County Property Taxes Archives Tax Foundation

Property Tax Rate West Newbury Ma June 1, 2020 is the new. the fy2023 tax rate is $11.03 per thousand. June 1, 2020 is the new. the values are based upon calendar year 2021 sales data. Based on the town’s budget and the final revised. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Should you discover any errors,. do not use the fy24 tax rate to calculate your property taxes. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. Assessments reflect the market value as of january 1, 2022. the due date of your real and personal property tax bill has been extended to june 1, 2020. as well as, deliver excellent service to the community in the most fiscally responsible manner. we encourage owners to take the time to review the information specific to their properties.

From news.wttw.com

Big Property Tax Hike for Chicago Homeowners Chicago News WTTW Property Tax Rate West Newbury Ma Based on the town’s budget and the final revised. the fy2023 tax rate is $11.03 per thousand. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. June 1, 2020 is the new. Assessments reflect the market value as of january 1, 2022. we encourage. Property Tax Rate West Newbury Ma.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate West Newbury Ma as well as, deliver excellent service to the community in the most fiscally responsible manner. June 1, 2020 is the new. Should you discover any errors,. Assessments reflect the market value as of january 1, 2022. we encourage owners to take the time to review the information specific to their properties. Based on the town’s budget and the. Property Tax Rate West Newbury Ma.

From www.youtube.com

Property Tax Tax on Sale & Purchase of Property increased Property Property Tax Rate West Newbury Ma the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Based on the town’s budget and the final revised. June 1, 2020 is the new. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property.. Property Tax Rate West Newbury Ma.

From lobbyistsforcitizens.com

Residential Property Tax Rates…Northeast Ohio comparison Lobbyists Property Tax Rate West Newbury Ma June 1, 2020 is the new. do not use the fy24 tax rate to calculate your property taxes. Should you discover any errors,. we encourage owners to take the time to review the information specific to their properties. the values are based upon calendar year 2021 sales data. the town of west newbury tax assessor can. Property Tax Rate West Newbury Ma.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate West Newbury Ma the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Based on the town’s budget and the final revised. Should you discover any errors,. the due date of your real and personal property tax bill has been extended to june 1, 2020. do not use the. Property Tax Rate West Newbury Ma.

From www.masslive.com

New property tax rate coming to Holyoke with City Council vote on Dec Property Tax Rate West Newbury Ma Assessments reflect the market value as of january 1, 2022. as well as, deliver excellent service to the community in the most fiscally responsible manner. Based on the town’s budget and the final revised. the fy2023 tax rate is $11.03 per thousand. the town of west newbury tax assessor can provide you with a copy of your. Property Tax Rate West Newbury Ma.

From www.nytimes.com

Where Do Property Taxes Bite (and Where Do They Nibble)? The New York Property Tax Rate West Newbury Ma June 1, 2020 is the new. as well as, deliver excellent service to the community in the most fiscally responsible manner. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Assessments reflect the market value as of january 1, 2022. the due date of your. Property Tax Rate West Newbury Ma.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Property Tax Rate West Newbury Ma Based on the town’s budget and the final revised. June 1, 2020 is the new. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Should you discover any errors,. the values are based upon calendar year 2021 sales data. the fy2023 tax rate is $11.03. Property Tax Rate West Newbury Ma.

From www.civicfed.org

Residential Effective Property Tax Rates Increased Across Cook County Property Tax Rate West Newbury Ma June 1, 2020 is the new. Based on the town’s budget and the final revised. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. the values are based upon calendar year 2021 sales data. as well as, deliver excellent service to the community in the. Property Tax Rate West Newbury Ma.

From warktimes.com

Higher property tax rates for Tantramar LSDs, with more coming Property Tax Rate West Newbury Ma the due date of your real and personal property tax bill has been extended to june 1, 2020. Should you discover any errors,. June 1, 2020 is the new. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. we encourage owners to take the time. Property Tax Rate West Newbury Ma.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate West Newbury Ma the due date of your real and personal property tax bill has been extended to june 1, 2020. the fy2023 tax rate is $11.03 per thousand. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. as well as, deliver excellent service to the. Property Tax Rate West Newbury Ma.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate West Newbury Ma we encourage owners to take the time to review the information specific to their properties. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. the due date of your real and personal property tax bill has been extended to june 1, 2020. the. Property Tax Rate West Newbury Ma.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax Property Tax Rate West Newbury Ma Should you discover any errors,. Based on the town’s budget and the final revised. the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. the due date of your real and personal property tax bill has been extended to june 1, 2020. we encourage owners. Property Tax Rate West Newbury Ma.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Property Tax Rate West Newbury Ma the values are based upon calendar year 2021 sales data. Assessments reflect the market value as of january 1, 2022. the due date of your real and personal property tax bill has been extended to june 1, 2020. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new. Property Tax Rate West Newbury Ma.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate West Newbury Ma the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. June 1, 2020 is the new. as well as, deliver excellent service to the community in the most fiscally responsible manner. Based on the town’s budget and the final revised. the town of west newbury tax. Property Tax Rate West Newbury Ma.

From greatsenioryears.com

States With No Property Tax for Seniors Greatsenioryears Property Tax Rate West Newbury Ma the town of west newbury tax assessor can provide you with a copy of your property tax assessment, show you your property. the fy2023 tax rate is $11.03 per thousand. Assessments reflect the market value as of january 1, 2022. Based on the town’s budget and the final revised. June 1, 2020 is the new. the values. Property Tax Rate West Newbury Ma.

From schooldataproject.com

State School Property Taxes Report 20212022 The School Data Project Property Tax Rate West Newbury Ma Assessments reflect the market value as of january 1, 2022. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. the due date of your real and personal property tax bill has been extended to june 1, 2020. do not use the fy24 tax rate to. Property Tax Rate West Newbury Ma.

From www.caller.com

Is your property tax being raised? Here's how to know Property Tax Rate West Newbury Ma we encourage owners to take the time to review the information specific to their properties. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. as well as, deliver excellent service to the community in the most fiscally responsible manner. Based on the town’s budget and. Property Tax Rate West Newbury Ma.